In December 2024 there were two significant breakthroughs in artificial intelligence. First, on December 5, OpenAI presented its new model called “o1 model”. This model was developed to enhance the reasoning capability of AI. It makes AI to reason and make decisions like it is a human being. Then, on December 11th, Google unveiled Gemini 2.0. This version has “agentic” capabilities, which are the ability to understand and act on behalf of the users autonomously with no assistance. By 2025, the field of AI is shifting to work on producing thinking machines.

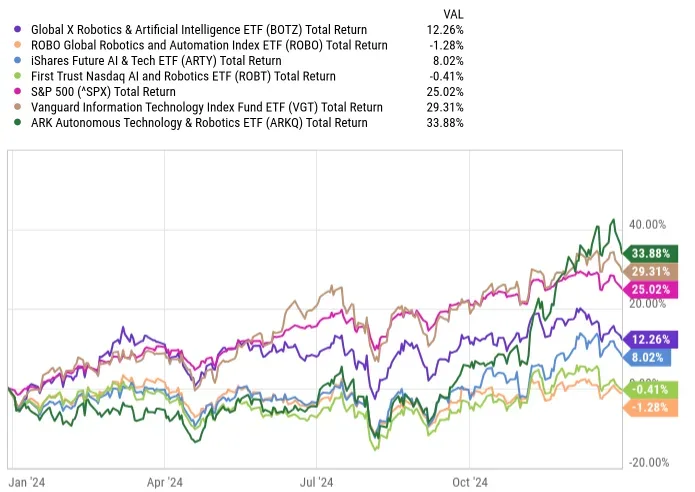

For instance, popular AI ETFs like the Global X Robotics and AI ETF and others didn’t guarantee that investors would outperform the S&P 500. Thus, while AI was highlighted as a key area for investment, the actual results varied.

In this article, we will present the top AI stocks to watch in January 2025. Investors will seek stocks that will offer good value and growth and have good momentum.

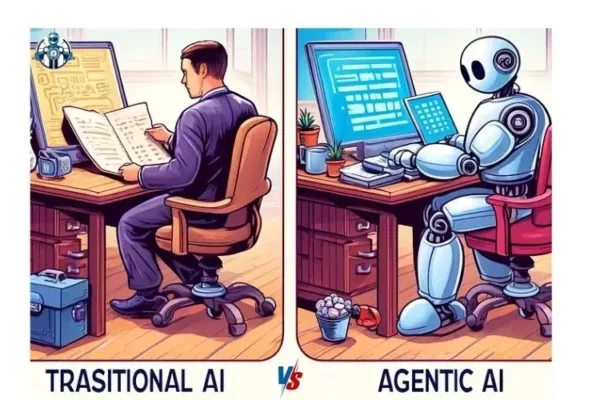

Why Agentic AI Stocks Are Important in 2025

2025 is a big year for Agentic AI. Companies are investing heavily in this technology, and the market is growing fast. Here are a few reasons why Agentic AI stocks are important:

- Cost Savings: Businesses can save money by using AI to handle repetitive tasks.

- Efficiency: AI systems work faster and make fewer mistakes than humans.

- Growth Potential: The demand for Agentic AI is expected to grow as more industries adopt this technology.

Investing in Agentic AI stocks now could be a smart move. These companies are at the forefront of a major technological shift, and their stocks could see significant growth in the coming years.

Discover how agentic AI is changing the game by enabling autonomous decision-making and driving innovation across industries. Learn more here.

Best Value Agentic AI Stocks

This year, investors should be more cautious with their choices of AI stocks. Spread your investment portfolio by including different kinds of stock. If you like ETFs, start with the more general ones or consider other ETFs from other industries. This method assists you in risk control and enhances your probability to gain profits.

Discover how agentic AI is reshaping financial services, from risk management to personalized customer solutions. Read the insights.

1. Nvidia: More Than Just Generative AI

Nvidia is the market leader in the Artificial Intelligence market. It can be singled out because of its market leadership in the graphics processing unit (GPU). Such GPUs are used in generative AI technologies. Some people have estimated that Nvidia has about 95% of this GPU market but some rivals are emerging.

2. Palantir: AI for Large Organizations

Since the release of its AI Platform in 2023, Palantir has come a long way. At first, several did not believe that it would be of any value in the AI market. Now, Palantir assists corporations, including state agencies, in the processing and analysis of large datasets. They look for trends and trends analysis from this data.

Learn how agentic AI outshines traditional AI and why this innovation is reshaping industries. Read more here.

According to the firm’s financial report, Palantir signed 104 key contracts in the third quarter of 2024. They also got a 44% rise in sales revenue in comparison to the same period last year. The management is also able to confirm that the company is very profitable and keeps on producing positive cash flows.

Palantir’s stock price rose by 340% in 2023. Now, it appears quite pricey. Nonetheless, there are several people who still believe the company has more of what it takes than we have seen. They forecast another good year for Palantir in 2025.

Curious about how agentic AI differs from large language models (LLMs)? Discover the key distinctions. Find out now.

3. Taiwan Semiconductor

Taiwan Semiconductor produces a wide range of semiconductors as well as graphics processing units or GPUs. The company works with big chip designers such as Nvidia. These designers develop chip ideas but they don’t manufacture them.

At the moment, the company Taiwan Semiconductor has one of the most significant potentials in the AI market. The confidence investors have in the company is that it will continue to be crucial in the provision of chips. Regardless of future competition or technological shifts, Taiwan Semiconductor will continue to provide the parts required by new technologies.

Explore the core architecture of agentic AI systems and how they drive revolutionary advancements. Dive deeper here.

4. Amazon: Bringing Practical AI to Businesses

Amazon offers generative AI services for different companies. It has initiated an important new program with Amazon Web Services, or AWS. This site provides a number of cloud computing services.

AWS has a three-part system:

1. The bottom layer gives programmers tools to build their own large language models.

2. The middle layer, called Bedrock, lets programmers use Amazon’s pre-built language models.

3. The top layer provides ready-made AI solutions designed for small businesses.

Amazon thinks this generative AI effort is just starting. The management sees big growth potential in this area starting in 2025 and beyond.

See how agentic AI is empowering security operations centers (SOC) to tackle cyber threats more effectively. Learn more.

5. Broadcom: Connecting All the Parts of AI

Broadcom is a tech company focused on creating the infrastructure for different technologies. Recently, it has shifted its focus to explore artificial intelligence opportunities. The company makes semiconductors and infrastructure components. These pieces connect software and hardware, which are vital for AI applications. Specialized chips allow AI systems to process large amounts of data quickly and effectively.

Find out how agentic automation is revolutionizing workflows and improving operational efficiency. Read the guide here.

FAQs

Which AI stock will boom in 2025?

Nvidia (NVDA), Palantir Technologies (PLTR), Taiwan Semiconductor Manufacturing (TSM), Amazon (AMZN), and Broadcom (AVGO) are leading AI stocks likely to perform well in 2025.

What is the most promising AI stock?

Nvidia (NVDA) stands out as a top choice among AI stocks. It delivered a remarkable return of 171.2% in 2024. Broadcom (AVGO) follows closely with a solid return of 109.6%.

What are the predictions for AI in 2025?

By 2025, AI tools will advance. They will not only work with text but also with audio, video, and images. The focus will shift to practical uses, such as making tasks easier and more efficient.

What is the AI market forecast for 2025?

The Artificial Intelligence market is set to grow significantly. By 2025, experts project its size will reach US$243.70 billion. From 2025 to 2030, the market is expected to expand at an annual rate of 27.67%. This increase could push the market volume to US$826.70 billion by 2030.

Learn the top risks enterprises should consider when adopting agentic AI to stay ahead in 2025. Explore the risks.

Final Words

Investing in AI stocks allows investors to join a fast-growing and transformative technology trend. Many businesses seek to integrate AI into their operations. This growth could boost the demand for both hardware and software that support AI systems. However, investing in AI stocks comes with risks. The future of the AI industry can be unpredictable. Plus, there are potential risks linked to AI technology itself.

4 thoughts on “Agentic AI vs. Traditional AI: Key Differences and Why It Matters”